If COVID-19 taught us anything, it’s that the unexpected may happen at any time. Whether it’s a pandemic or a natural disaster, it’s important to be prepared so the safety and health of your employees remains the top priority while your organization weathers the challenges.

Every organization should have disaster and business continuity plans so they are prepared if—and when—disasters strike.

The ins and outs of disaster planning

When the pandemic struck, many organizations were caught off guard as non-essential workers across the U.S. and around the globe were suddenly sent home. Without a plan to help them respond to and recover from disaster, they were left scrambling.

Creating a disaster plan requires leaders and employees to work together. The first step is to decide which types of disasters are most likely to occur in your location. Common disasters around the world include:

- Meteorological disasters, such as flooding, dam and levee failure, severe thunderstorm (wind, rain, lightning, hail), tornadoes, windstorms, hurricanes, tropical storms and winter Storm (snow/ice)

- Geological disasters, such as earthquakes, tsunamis, landslides, sinkholes and volcano eruptions

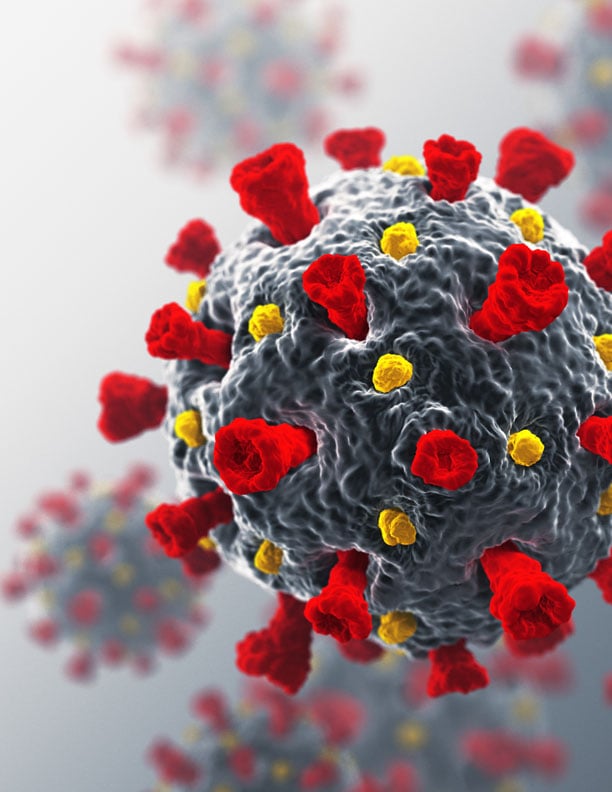

- Biological disasters, such as pandemic diseases and foodborne illnesses

Next, set goals that support your business needs. It’s important to consider:

- Employee safety and security

- How to stay up to date on information that is critical to your business

- Supplies for extended stays if employees must remain at work for long periods of time

- How to evacuate your employees if necessary

- Planning for multiple business locations and any lessees you may have

- How you can continue to provide critical business operations for the public

When creating a disaster plan, be sure to include all key people in its development, such as ownership, management and a range of employees from different parts of the company. The planning committee may also include vendors and contractors who have unique insights and expertise.

Then, look at all possible risk scenarios, ranking how likely they are. This will help you create a plan that is realistic. Some possible risks include hazards, such as:

- Fires

- Explosions

- Toxic spills

- Terrorism

- Workplace violence

- Power, water or natural gas outages

- Supplier failures

- Mechanical breakdowns

- Cyber attacks

After that, think about what could happen in each of these events. Potential outcomes include:

- Injuries

- Property damage

- Business interruption

- Loss of customers

- Environmental contamination

- Fines

- Penalties

- Lawsuits

Experts suggest using checklists by types of disaster to create quick reference guides. If an emergency does happen, you can refer to the guide so you can respond quickly to protect your employees and your assets.

Be sure your plan includes a complete list of emergency contacts and any contractors you may need for emergency repairs and backup. This will help you reach the people you need to help get your business up and running as soon as possible.

Make sure each section of your plan includes an emergency response plan complete with maps and meet-up locations if employees need to evacuate during an emergency. It’s important to document any practice drills you run and training you offer, too.

Remember, OSHA requires businesses to have emergency plans in place. You can share your emergency plan verbally if you have fewer than 10 employees, but you must have a written plan if you have 11 or more. Don’t forget to train all your team members on your emergency plans, including new employees you hire.

If you need help creating your disaster plan, visit OSHA’s Emergency Preparedness and Response Page. This website has useful information about:

- Types of disasters

- How to prepare your business for an emergency

- Where to find more support if you need it

Keeping the business going

With your disaster response plan in hand, it’s time to develop a business continuity plan. This will help your organization get back on track with as little trouble as possible if there is a disaster. Having this kind of plan can lessen the impact and damage caused by an unexpected event.

Start by conducting a risk assessment of any possible problems and obstacles. Then identify key employees and how important work gets done at your company. You can use this information to set recovery priorities and estimate recovery times. Make sure no stone goes unturned. Ask “what if,” and be sure to have back-up plans in place in case something goes wrong.

When it’s time to develop your plan, it’s a good idea to use best practices that have a track record of success. This include:

- Involving a variety of employees from top leadership down

- Assigning key tasks, deadlines and responsibilities

- Having a plan for each location your business operates

- Considering vendors, contractors and lessees and the roles they play in keeping your business going

- Making sure the owner and leaders approve the plan

- Distributing the plan to employees so they have it handy if and when they need it

A work in progress

Remember, managing risk is an ongoing process. Plans are supposed to be living documents that are regularly reviewed and updated. Each year, review your disaster preparedness and business continuity plans to ensure they are still relevant. If you find any new risks, make sure to change your plans to address current threats. Be sure to send the emergency plan and the business continuity plan to employees again so they are aware of any updates you make.

It’s important to take time and effort to plan for the unexpected. When you do, you protect your business because you will be able to meet different types of disasters without skipping a beat.

CopperPoint Insurance Companies is a western-based super regional commercial insurance company and a leading provider of workers’ compensation and commercial insurance solutions. With an expanded line of insurance products and a growing 10 state footprint in the western United States, CopperPoint is in a strong position to meet the evolving needs of our brokers, agents and customers.

To learn more about our insurance products and find resources to better manage your risks, explore our website or contact your independent insurance agent.