Notice Update: CopperPoint.com will be temporarily down for maintenance on July 2, beginning at 7:30PM PST. Users may still access the portal through direct links.

Premium Audit

- Policyholder

- Policyholders

- Premium Audit

A Process that is Easy and Straightforward

Premium Audit conducts final audits after a policy has expired to true up the premium on your workers' compensation and general liability insurance policies. The premium audit process allows us to compare the original estimated exposure against your actual exposure to determine your final premium and to verify your business operations. We value communication, cooperation and respect. For us, doing well and doing right are the same thing.

Ease of Doing Business

To make the audit process as easy as possible we utilize multiple audit methods for completing audits.

What You Can Expect

The method we will use for completing your audit is based on premium size, the type of operation and state requirements. Depending upon the method used, you may receive self-audit forms from a staff auditor or a vendor partner requesting final audit information; alternatively, you may receive communication from a field auditor requesting a Physical-Field Audit or Physical-Virtual Audit (also referred to as a Remote Physical Audit).

Our Commitment

Our commitment goes beyond conducting an accurate audit, it is also our belief you should only pay premium for your actual exposure. When you need assistance, we will be here to help.

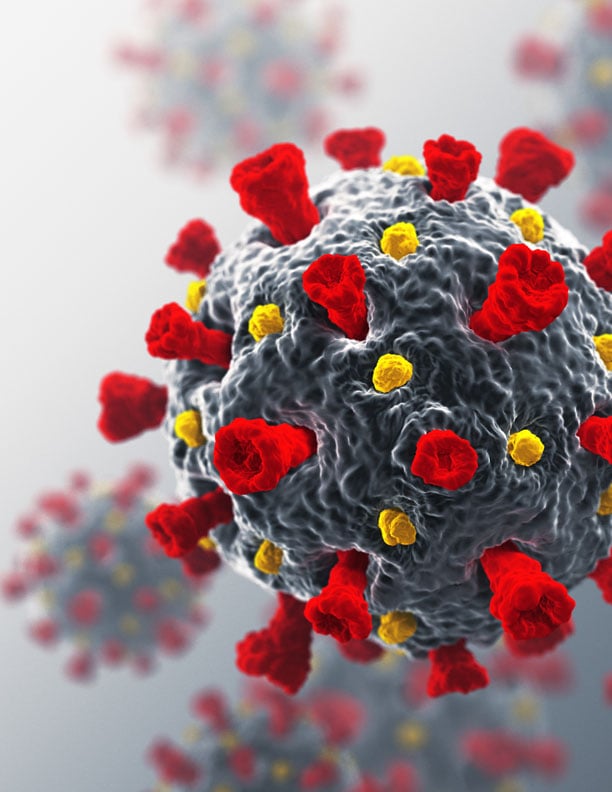

CopperPoint’s COVID-19 response for On-Site Visits

As we move back to in-person meetings, all CopperPoint field employees, including Loss Control, Risk Management, Distribution and Premium Audit are committed to providing safe in-person meetings. We will continue to monitor and adhere to CDC and OSHA guidance as we conduct meetings and physical surveys.